how to reduce taxable income for high earners australia

So Call us on 0280625961 or Book an Appointment. The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000.

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

Tax deduction versus tax offset The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

. A discretionary trust would be used for distributing business profits investments. 12 Tax Gain Harvesting. Because she stays at home she only has to pay 13500 in taxes.

Use your Franking Credits wisely to reduce taxes. Taxable investing accounts can be very tax-efficient for these folks. Tax deductions you may want to maximize.

Max Out Your Retirement Contributions. How to Reduce Taxable Income Through Charitable Donations. These penalties can range from fines to imprisonment for more.

Franking credits can reduce the income tax paid on dividends or potentially be received as a tax refund. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits.

To reduce your reportable income you should start with maxing out your pre-tax 401k. Make spousal contributions to reduce your tax liability. Effective tax planning with a qualified accountanttax specialist can help you to do that.

Lets start with retirement accounts. Many people dont realize this but below a taxable income of 40400 80800 married you dont pay taxes on long term capital gains or qualified dividends for that matter. Come in for a review at no cost and see what possible.

Invest in an investment bond to minimise your taxable income. Consider salary sacrificing to reduce your taxable income. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice.

Hold investments in a discretionary family trust for tax-effective income distribution. How to reduce taxable income for high earners through your employer benefits. Here are 9 ways to accomplish your goal and reduce your tax bill.

You are allowed to claim a tax deduction depending on the type of donation. This is achieved by utilising the tax paid by the company which is passed on to the shareholder when a Franked Dividend is paid. The taking care of your partners assets.

So the money was distributed to Mary. Negatively gear your investment property to reduce your taxable income. Because his income is so high any extra income will be taxed at the highest rate currently at 465.

A DRG deductible gift recipient is an ATO recognised organisation or fund that can receive tax-deductible gifts. If you are a high-income earner it is sensible to implement tax minimisation strategies. Max your pre-tax 401k.

How Can A High Earner Reduce Taxable Income In Australia. You are just taking advantage of some price fluctuations to lower your tax bill. Because of the way Australias income tax system is structured moving.

The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. One way to reduce your taxable income is to donate to a DRG organisation.

How To Reduce Taxable Income For High Earners Australia. Most employers will give you the option of a pre-tax or a Roth 401k. Use of Franking Credits in your tax planning can save you tax.

If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket. By offering qualified retirement plans such as 401 k 405 b or 457 employers may attract employees qualified to invest money in their retirementThose who earn high incomes can minimize taxes with one of. Dont waste your good fortune or hard work by not assessing if you are using the system to your advantage.

A Roth retirement account has its own benefits but it wont reduce your income this year.

What Is Taxable Income With Examples Thestreet

Worried About Taxes Going Up 9 Ways To Reduce Tax

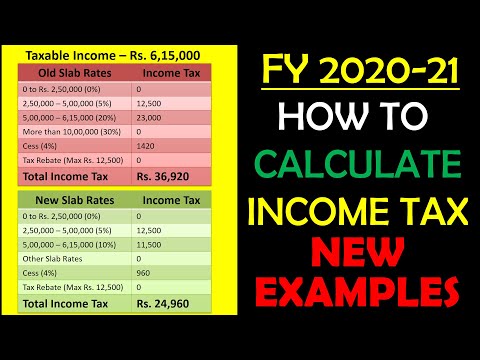

How Is Taxable Income Calculated

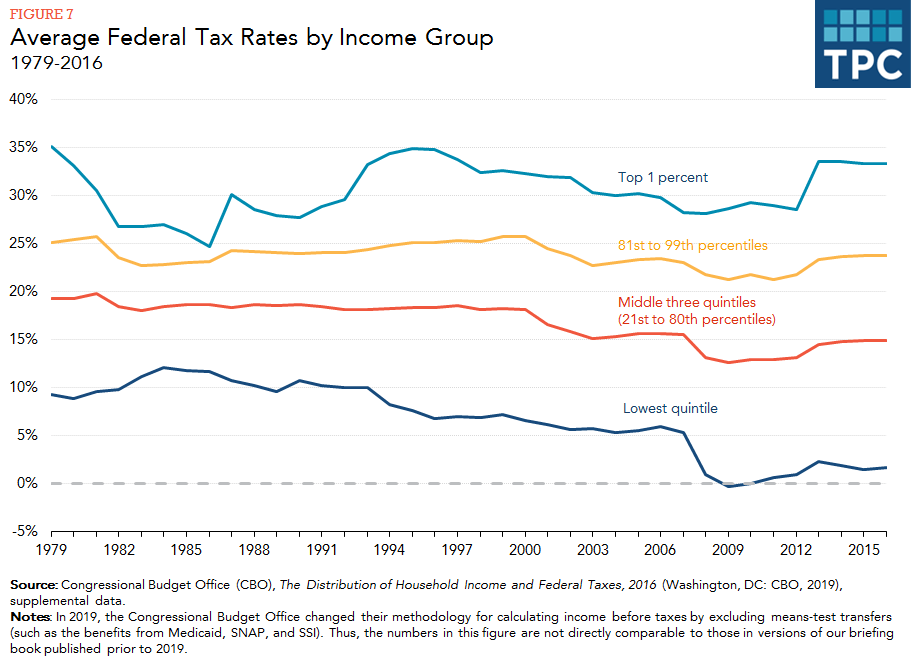

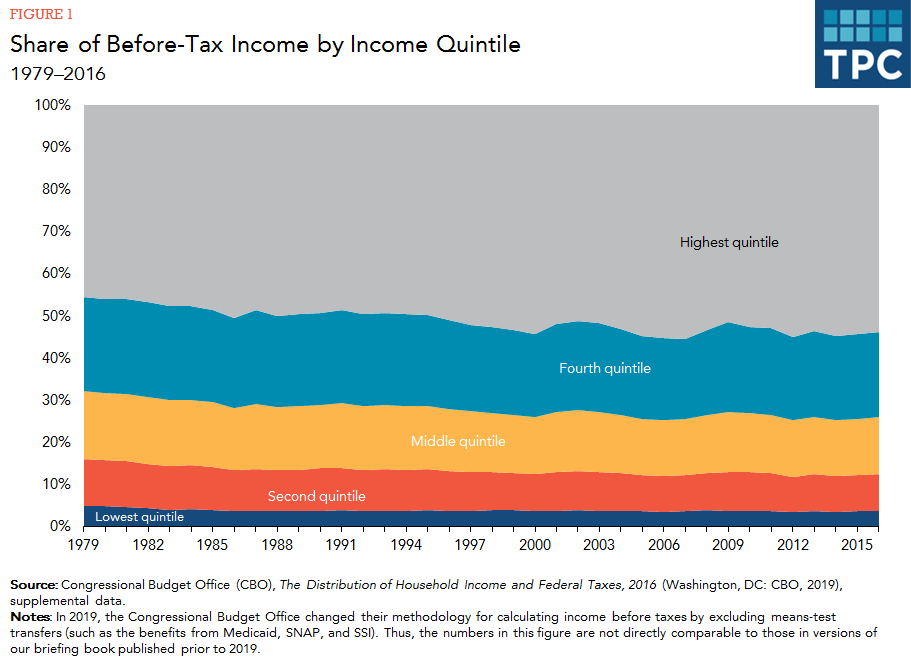

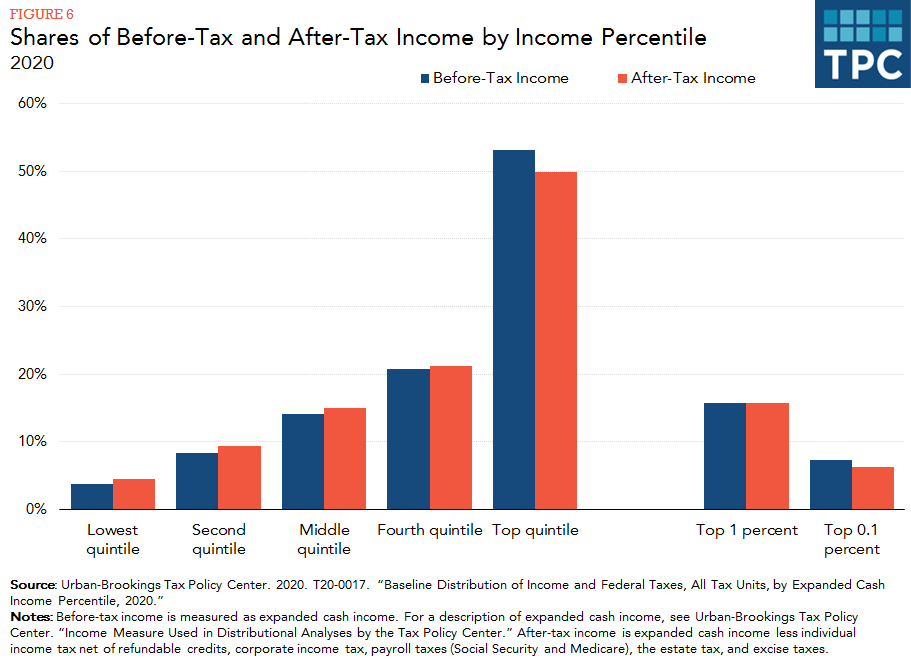

How Do Taxes Affect Income Inequality Tax Policy Center

Income Tax News Research And Analysis The Conversation Page 1

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How Do Taxes Affect Income Inequality Tax Policy Center

How Do 401 K Tax Deductions Work

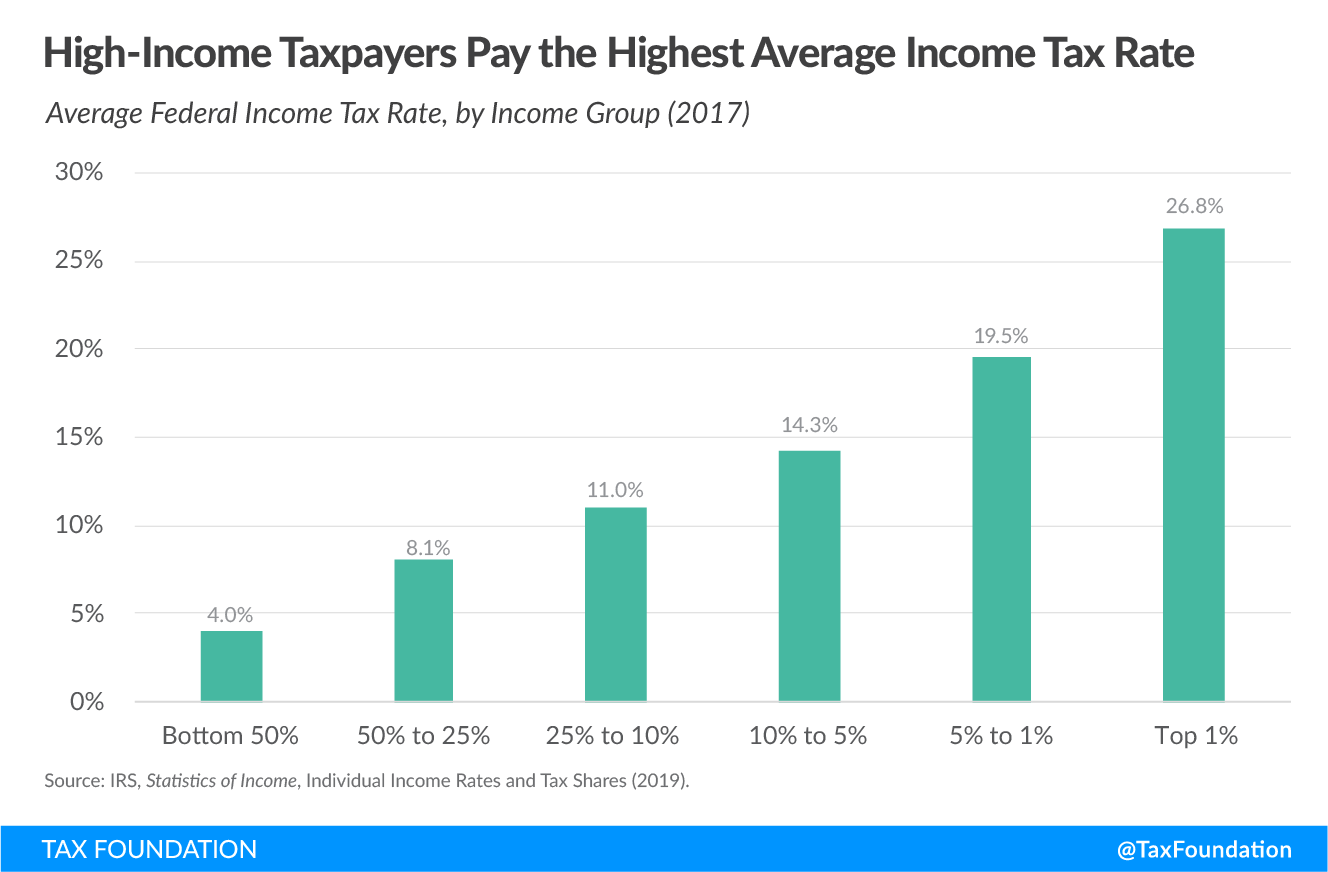

Progressive Tax Definition Taxedu Tax Foundation

Progressive Tax Definition Taxedu Tax Foundation

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

What Is Taxable Income And How To Calculate It Forbes Advisor

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

How Do Taxes Affect Income Inequality Tax Policy Center

Progressive Tax Definition Taxedu Tax Foundation